The Ultimate Guide To Summitpath Llp

The Ultimate Guide To Summitpath Llp

Blog Article

The Of Summitpath Llp

Table of ContentsThe Best Strategy To Use For Summitpath LlpMore About Summitpath LlpGetting The Summitpath Llp To WorkTop Guidelines Of Summitpath LlpFascination About Summitpath Llp

A monitoring accountant is a crucial function within an organization, but what is the function and what are they anticipated to do in it? Functioning in the book-keeping or financing department, monitoring accounting professionals are responsible for the preparation of administration accounts and numerous various other reports whilst likewise supervising basic audit treatments and practices within the organization - affordable accounting firm.Assembling strategies that will reduce business costs. Obtaining finance for projects. Encouraging on the monetary ramifications of business decisions. Developing and overseeing monetary systems and treatments and determining possibilities to boost these. Managing earnings and expenditure within the service and making certain that expenditure is inline with spending plans. Managing accounting technicians and support with generic accountancy jobs.

Key financial information and reports produced by management accounting professionals are made use of by senior administration to make educated company decisions. The evaluation of company performance is a vital role in an administration accounting professional's work, this analysis is created by looking at current financial info and likewise non - economic information to figure out the placement of the organization.

Any company organisation with a monetary division will call for a monitoring accounting professional, they are likewise often utilized by banks. With experience, a monitoring accounting professional can anticipate solid career progression. Experts with the called for credentials and experience can take place to come to be economic controllers, money supervisors or primary economic policemans.

The Only Guide to Summitpath Llp

Can see, examine and recommend on alternative sources of business finance and various methods of elevating money. Communicates and advises what influence monetary decision making is having on developments in guideline, ethics and governance. Assesses and advises on the appropriate techniques to handle organization and organisational efficiency in relationship to service and financing risk while interacting the impact effectively.

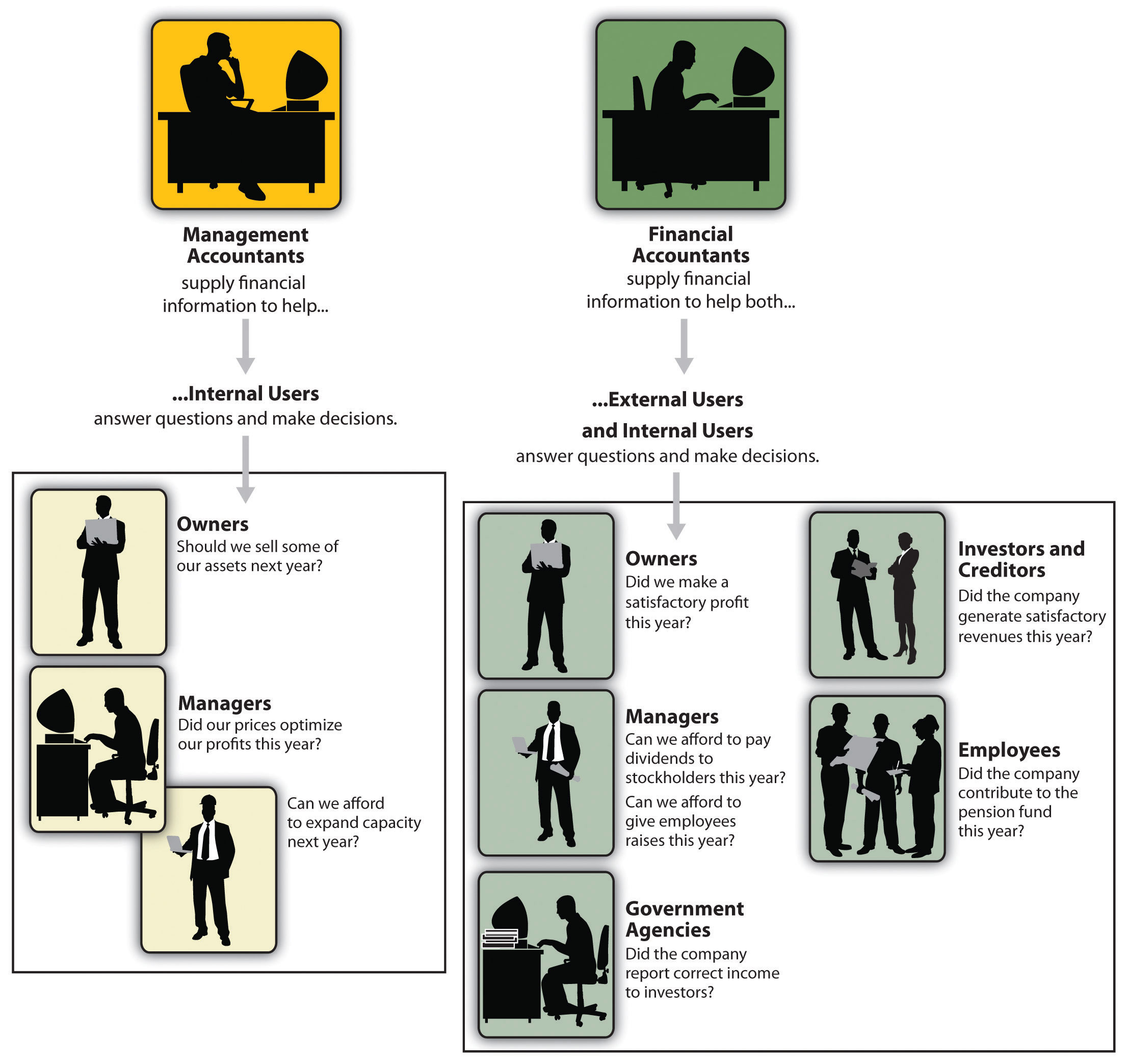

Utilizes numerous ingenious methods to carry out approach and handle change - CPA for small business. The difference in between both economic audit and managerial audit concerns the designated users of info. Supervisory accountants need business acumen and their purpose is to function as business companions, assisting magnate to make better-informed choices, while financial accountants intend to generate financial documents to provide to exterior celebrations

The Best Strategy To Use For Summitpath Llp

An understanding of organization is likewise vital for administration accountants, along with the capability to communicate efficiently whatsoever levels to recommend and communicate with elderly participants of personnel. The responsibilities of a monitoring accounting professional ought to be performed with a high level of organisational and critical reasoning abilities. The average salary for a legal administration accounting professional in the UK is 51,229, an increase from a 40,000 typical made by management accounting professionals without a chartership.

Giving mentorship and management to junior visit homepage accountants, fostering a culture of partnership, development, and operational quality. Collaborating with cross-functional groups to create spending plans, projections, and lasting monetary methods. Staying informed concerning adjustments in audit policies and ideal practices, using updates to interior processes and documentation. Must-have: Bachelor's level in audit, money, or an associated field (master's chosen). Certified public accountant or CMA accreditation.

Charitable paid time off (PTO) and company-observed holidays. Specialist growth possibilities, including compensation for CPA certification prices. Flexible job choices, including hybrid and remote routines. Access to health cares and worker support sources. To use, please submit your return to and a cover letter describing your qualifications and interest in the elderly accounting professional function. CPA for small business.

An Unbiased View of Summitpath Llp

We aspire to find a knowledgeable senior accounting professional all set to add to our firm's economic success. For inquiries concerning this position or the application procedure, call [HR get in touch with details] This work posting will certainly run out on [day] Craft each area of your job summary to show your company's special requirements, whether working with an elderly accounting professional, corporate accounting professional, or an additional expert.

A strong accountant job account exceeds providing dutiesit clearly connects the qualifications and assumptions that align with your company's requirements. Distinguish between crucial qualifications and nice-to-have skills to assist candidates assess their viability for the setting. Define any certifications that are required, such as a CERTIFIED PUBLIC ACCOUNTANT (Cpa) license or CMA (Qualified Administration Accountant) designation.

Getting My Summitpath Llp To Work

"prepare monthly financial statements and supervise tax filings" is much clearer than "handle financial records."Mention crucial areas, such as economic reporting, bookkeeping, or payroll management, to draw in prospects whose abilities match your requirements.

Accounting professionals aid companies make crucial economic decisions and corrections. Accounting professionals can be accountable for tax obligation coverage and filing, resolving balance sheets, aiding with departmental and organizational budget plans, financial forecasting, interacting findings with stakeholders, and a lot more.

Report this page